Borrow up to $35,000

Rates as low as 8.99%*

Funding as early as 1 business day

No hidden fees

See how a Fig personal loan can benefit you

Simplify your monthly payments

Consolidate your debt into one loan balance with easy-to-manage payments.

Save on interest

Transfer higher interest credit cards and debt, to a fixed, lower interest rate personal loan.

Improve your cash flow

Better financial flexibility could mean more money in your pocket for the things that really matter in life.

Trusted by thousands of happy Canadians

Friends in qualified places

We’re backed by lending experts Fairstone Bank and developed in collaboration with Koru, a one-of-a-kind venture studio owned by the Ontario Teachers’ Pension Plan, one of the world’s largest investors.

The smart way to get a personal loan

Competitive interest rates, apply in minutes. No hassle, no judgement.

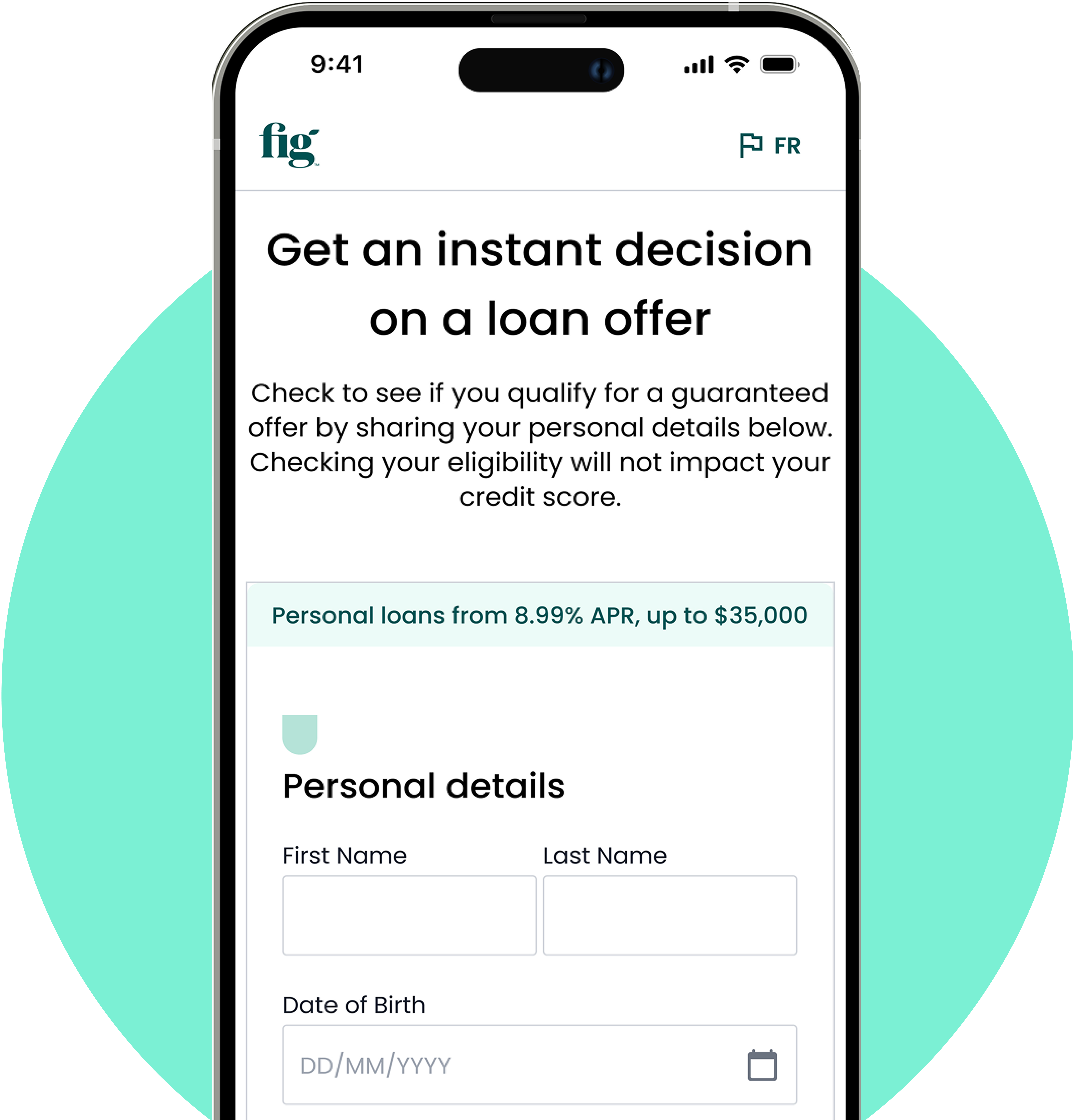

Check your rate in seconds

Find out how much you can borrow and your rate offer—without impacting your credit score.

Complete your application in minutes

Only a few verification steps remain. No branch visit, no lengthy paperwork.

Get your loan in days

Pay off your loan on your terms with flexible payments and no early repayment fees.

Transfer your debt and save

A personal loan can help you consolidate high-interest credit cards and debt, which could mean more money in your pocket. Pay off just one loan balance with a fixed interest rate and monthly payments, plus pay your remaining balance anytime with zero fees.

A Fig loan today helps keep high-interest debt away

A loan experience you’ll actually enjoy

With Fig, check your offer and complete your application in under 10 minutes, all from your desk, your phone, or while binging your favourite show.

With straightforward questions and a high level of data security, we make complex financial decisions simple.

Protect yourself with bank level security

As a subsidiary of Fairstone Bank, we hold ourselves to an extremely high standard when it comes to data security, privacy, and protecting your personal information. Your information belongs to you—period.

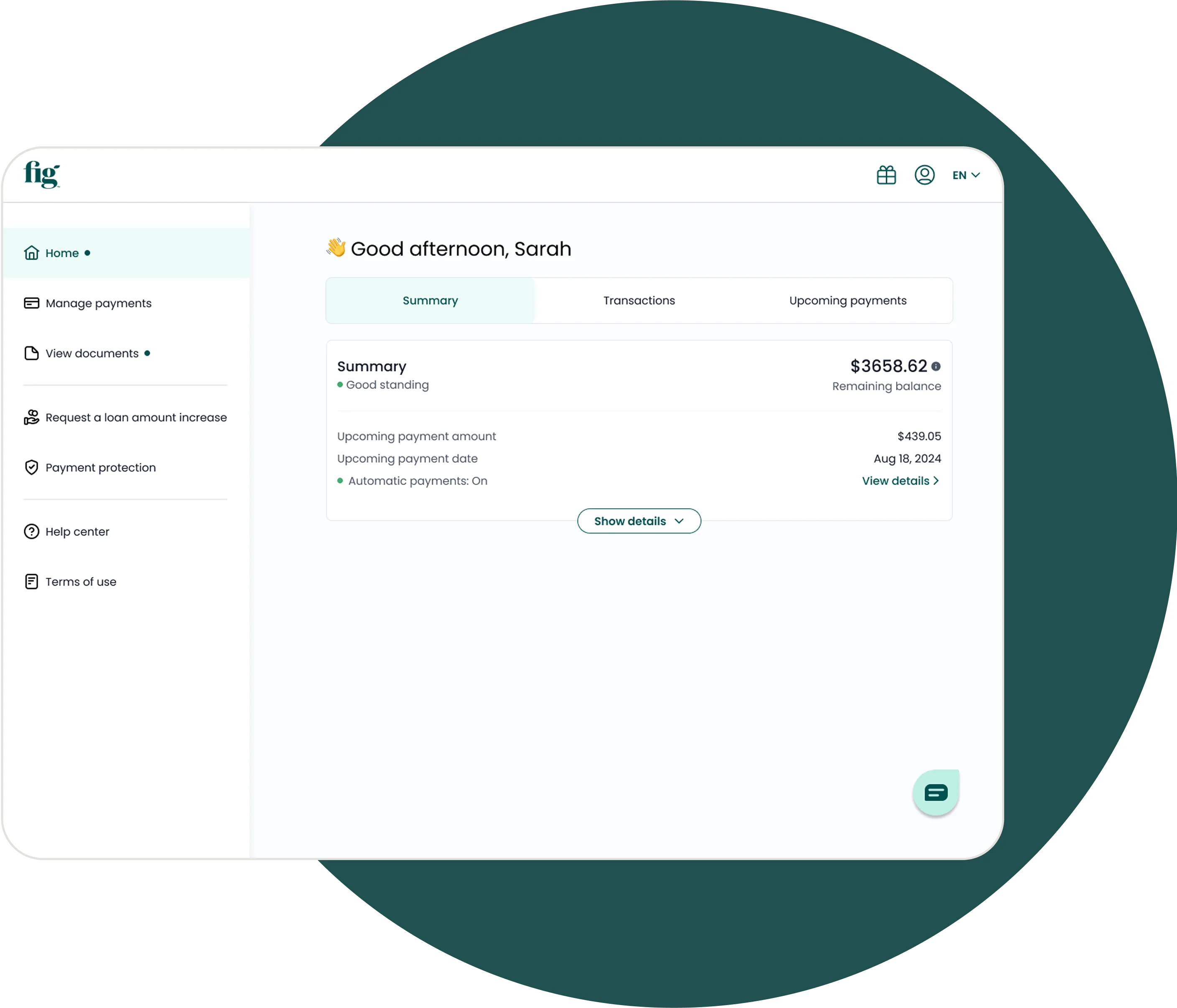

Support when, where, and how you need it.

When you need help, Fig is there, with a compassionate, Canadian-based team of support reps. Chat live Monday through Friday (9am - 5pm ET), visit our comprehensive help center, or submit a request anytime.

Whether you have questions about your rate, repayment terms, or deposit date, our team of financially-focused humans is just a question away.

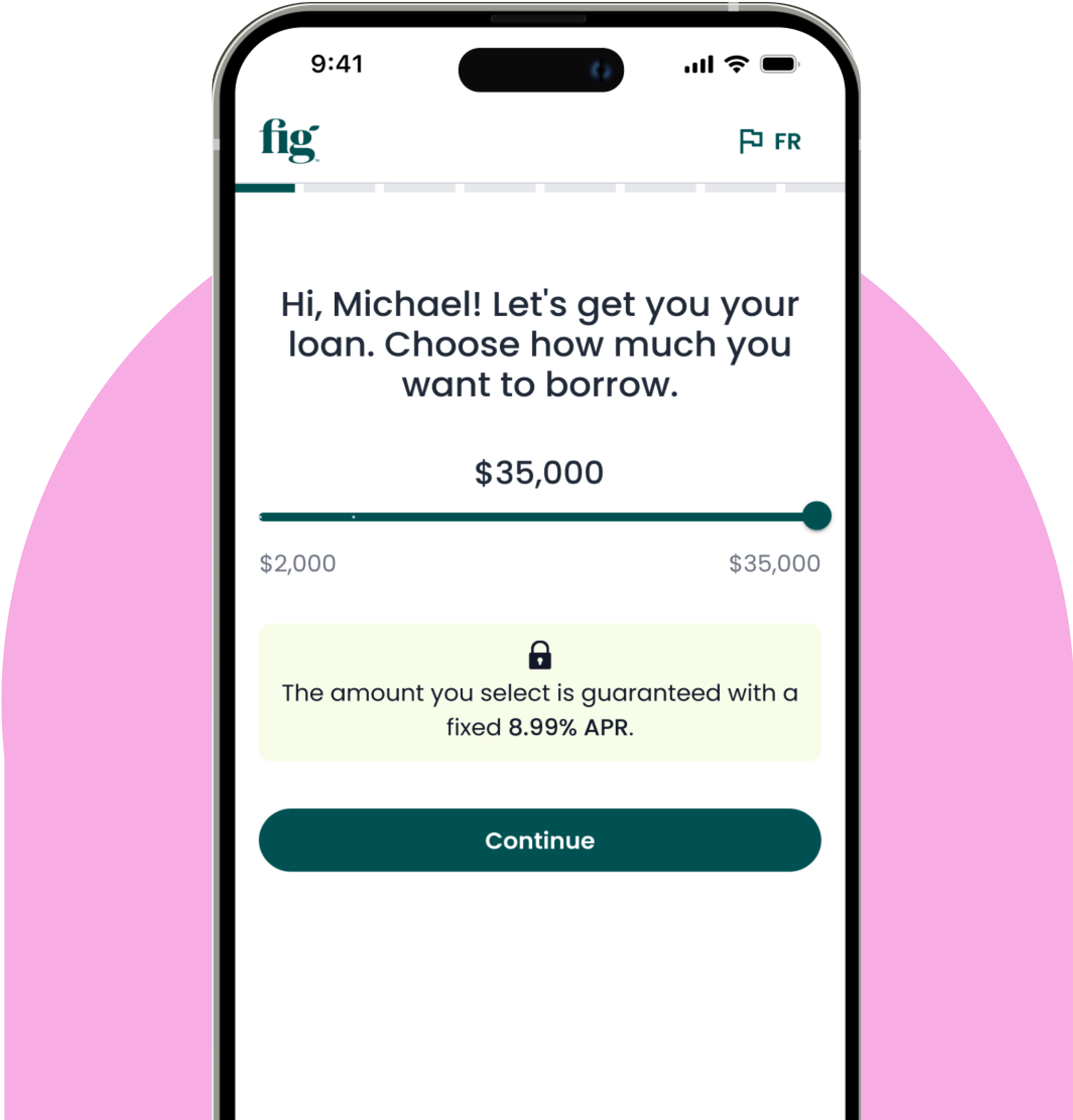

Full financial flexibility—really

It’s called a personal loan for a reason. You choose the amount to borrow, time frame, and the repayment schedule that works best for you. Need to skip a payment? Want to pay back your loan early, penalty-free? Just log in to your Fig account—no phone calls or branch visits required.

Quick answers to great questions

You bet.

We’re a small team of very real people who are trying to make the lending industry more human. To keep things lean, we skipped the brick-and-mortar location with the 9-5 hours in favour of a collaboration with Koru, a groundbreaking venture studio owned by the Ontario Teachers’ Pension Plan, one of the world’s largest investors.

Plus, since we’re backed by Fairstone Bank, we’re able to take advantage of industry-leading lending expertise, all while still offering a flexible approach to financial well-being.

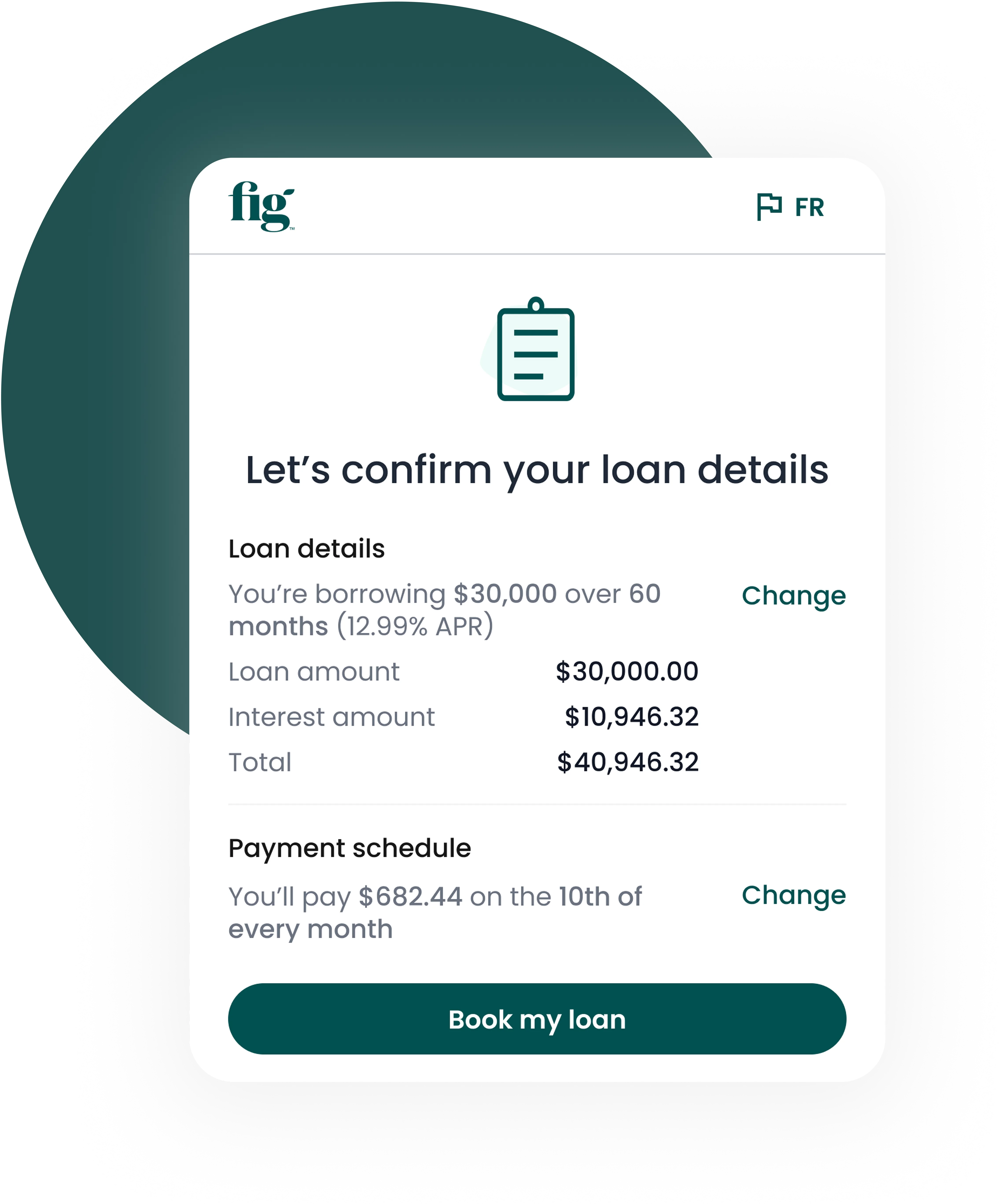

Your ‘guaranteed offer’ is your approved loan amount and fixed interest rate; you’ll see this once you complete the pre-qualification form.

Your loan amount and interest rate stay the same as you complete your application—no bait-and-switch here.

Our interest rates start at 8.99%*, and we keep them as competitive as possible. You can check your interest rate offer in just seconds—without impacting your credit score—for free.

Paying off your loan early should be a reason to celebrate, not to charge you money.

Our answer is no—no fees, no penalties, and no problem paying back part (or even all) of your loan at any time.

Yes and no.

Step 1: You can check your interest rate and loan approval amount (free!) without any impact on your credit score.

Step 2: Next, we use a soft credit check (which doesn’t impact your credit score) to gauge your eligibility and get you the best offer we can.

Step 3: To complete your loan application, we get your consent to do a hard credit check (and only if you’re okay with it).