Borrow up to $35,000

Rates as low as 8.99%*

Funding as early as 1 business day

No hidden fees

Transfer your debt and save

A personal loan can help you consolidate high-interest credit cards and debt, which could mean more money in your pocket. Pay off just one loan balance with a fixed interest rate and monthly payments, plus pay your remaining balance anytime with zero fees.

Why choose Fig for a debt consolidation loan

See how a debt consolidation loan can help you achieve financial freedom

‘Debt consolidation’

doesn’t have to be scary.

Debt consolidation means taking out one lower-interest rate loan and using the funds to pay off any super-high interest debts.

Debt consolidation means taking out one lower-interest rate loan and using the funds to pay off any super-high interest debts.

Simplify monthly payments

Less missed payments thanks to one monthly amount vs. several.

Less missed payments thanks to one monthly amount vs. several.

Save on interest

A lower interest rate than high-interest credit cards.

A lower interest rate than high-interest credit cards.

Improve your cash flow

Better financial flexibility could mean more money in your pocket for the things that really matter in life.

Better financial flexibility could mean more money in your pocket for the things that really matter in life.

Improve financial well-being

Ability to build your credit score if properly managed.

Ability to build your credit score if properly managed.

See how a Fig debt consolidation loan can benefit you

Trusted by thousands of happy Canadians

‘I am so grateful for my Fig loan.

I am so grateful for my Fig loan. It helped me consolidate all my credit card debt so I pay less Interest. Now I am paying only one monthly payment, which also gives me more financial freedom. Also I have the choice to pay more of the loan off when ever I want and with out any penalty. Fig is flexible and amazing.’

- Sunnilee

How to get a debt consolidation loan online

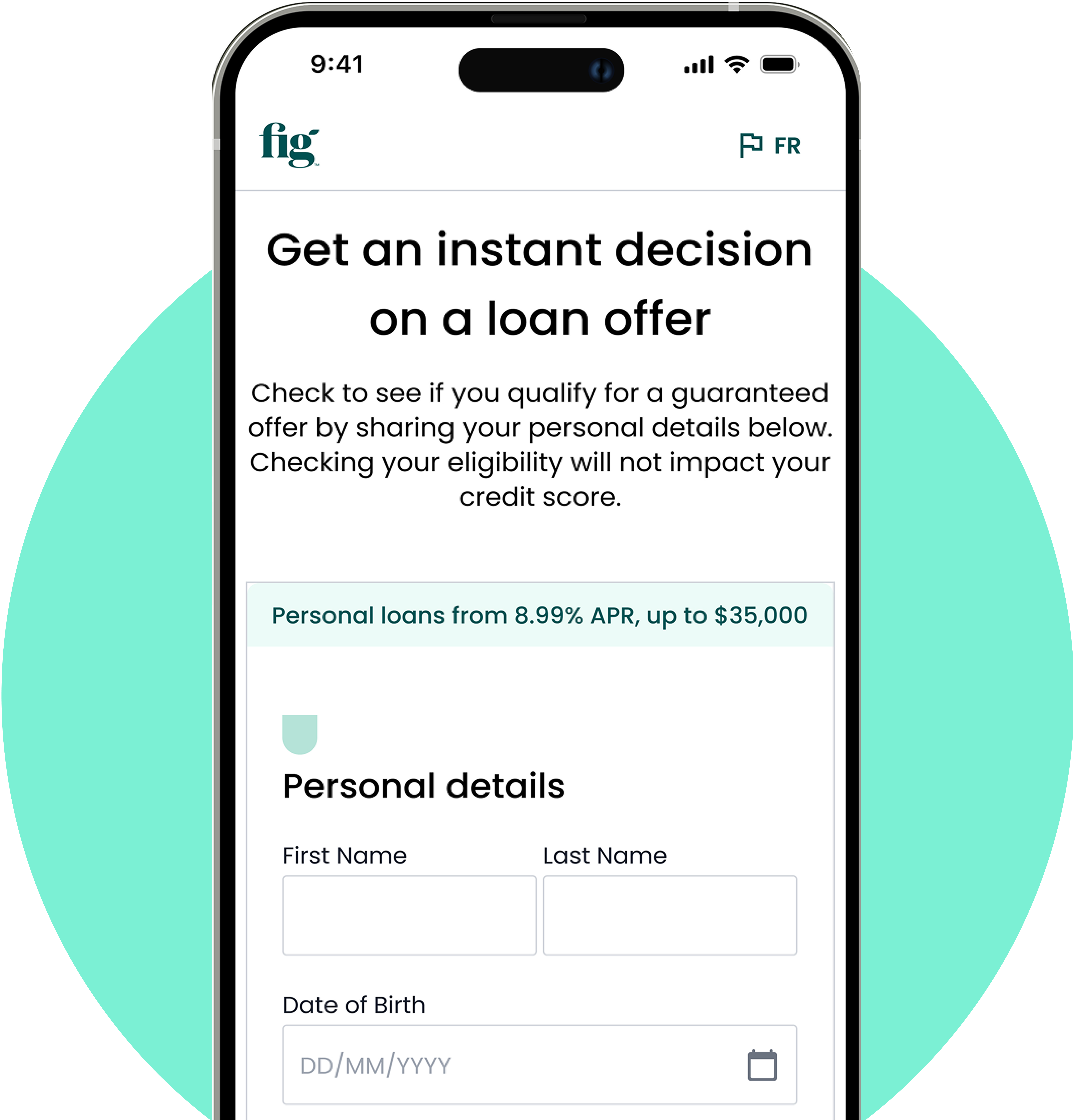

Check your rate in seconds

Find out how much you can borrow and your rate offer—without impacting your credit score.

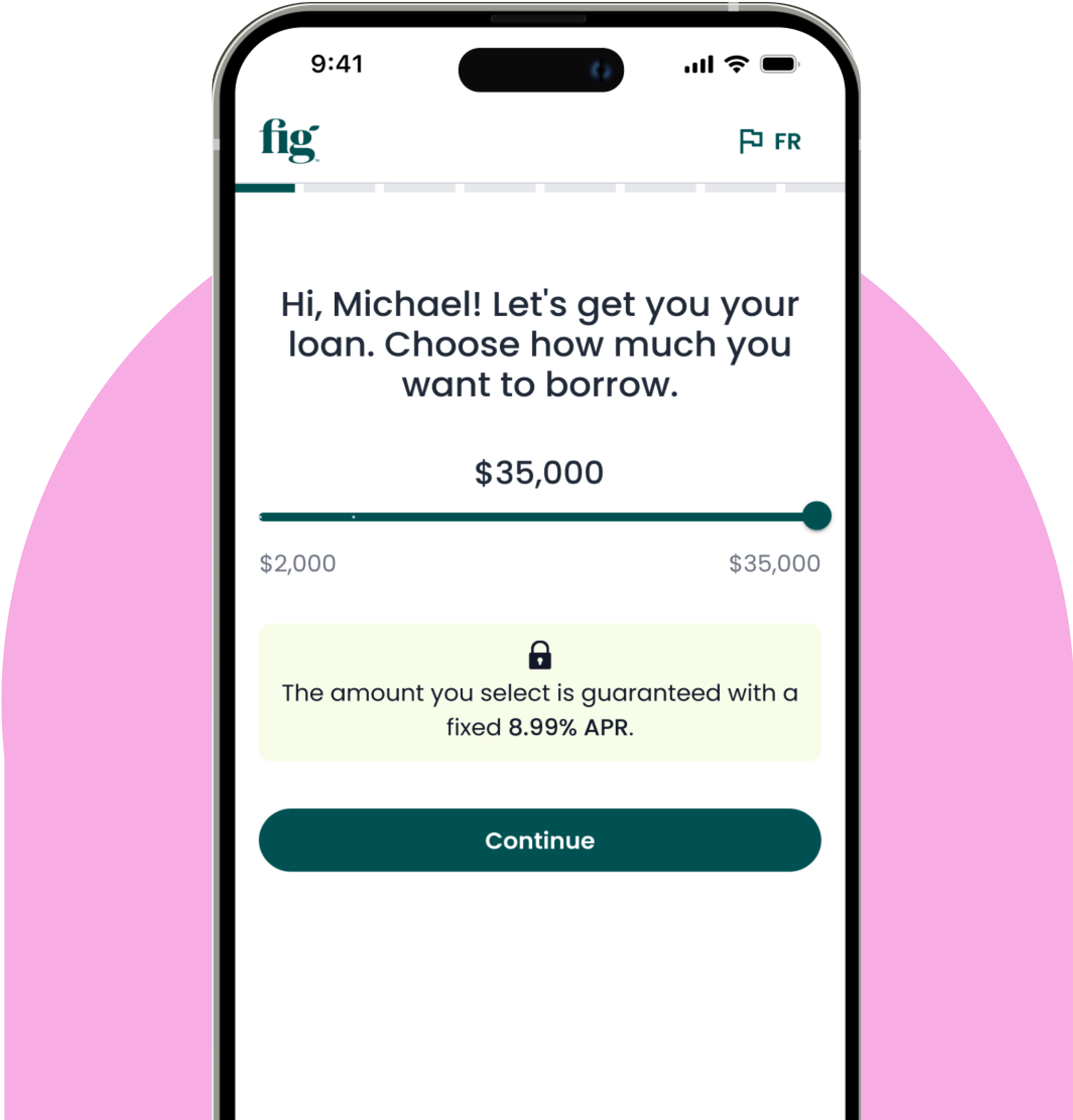

Complete your application in minutes

Only a few verification steps remain. No branch visit, no lengthy paperwork.

Get your loan in days

Pay off your loan on your terms with flexible payments and no early repayment fees.

Learn more about debt consolidation

Not sure if a debt consolidation loan is right for you? Check out our knowledge hub to learn more.

Debt consolidation loans FAQ

A debt consolidation loan is a type of loan used to combine multiple high-interest debts into a single loan, often with a lower interest rate or more favorable terms.

Debt consolidation loans can be beneficial for those with multiple high-interest debts who want to simplify their payments and potentially reduce their interest rates.

Benefits can include a lower interest rate, a single monthly payment, and the potential to pay off debt faster.