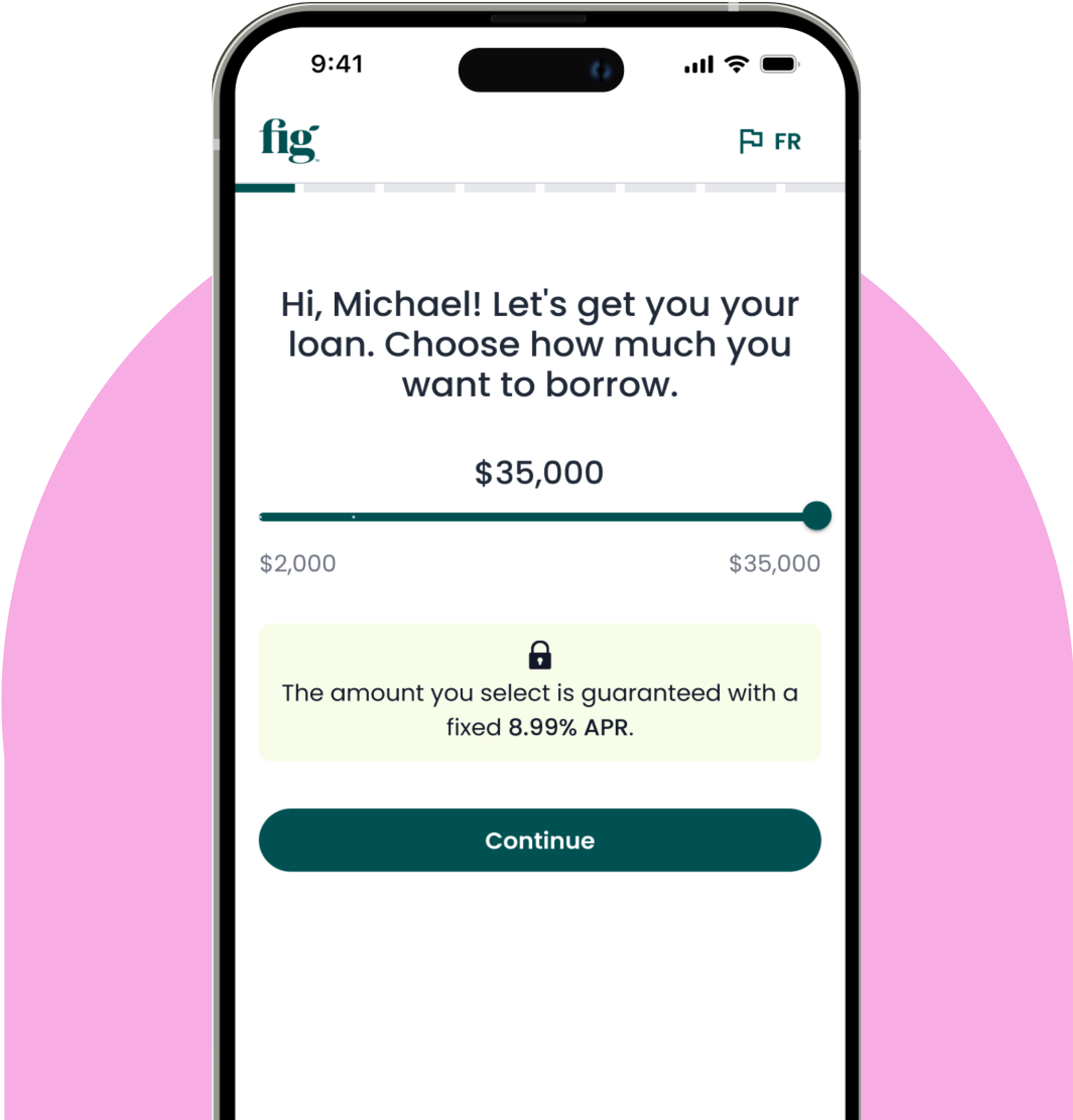

Borrow up to $35,000

Rates as low as 8.99%*

Funding as early as 1 business day

No hidden fees

See how a Fig home improvement loan can benefit you

Why choose Fig for a home improvement loan

See how a home improvement loan can help you kick-start your next project with ease

Project planning

made easy with a

loan from Fig

From contractor and materials selection to budgeting, cross funding off your list with a simple and secure online personal loan.

From contractor and materials selection to budgeting, cross funding off your list with a simple and secure online personal loan.

Better budgeting

Budget more effectively for your home improvement project with fixed monthly payments.

Budget more effectively for your home improvement project with fixed monthly payments.

Quick approvals

Check how much you could be approved for in less than 60 seconds - all from the comfort of your home.

Check how much you could be approved for in less than 60 seconds - all from the comfort of your home.

Fast funding

Receive your project funds directly in your bank account in as little as one business day.

Receive your project funds directly in your bank account in as little as one business day.

No fees

Project under budget? Enjoy the flexibility of paying back your loan early, with no fees.

Project under budget? Enjoy the flexibility of paying back your loan early, with no fees.

Trusted by thousands of happy Canadians

‘Easiest way to access funds …

I could not believe how easy it was for me to apply for a loan and get the funds in my bank account within 24hrs. Other financial institutions would take over 3 days asking for lots of information and records that could discourage someone to continue the application process.’’

- Chukwuemeka

How to get a home improvement loan online

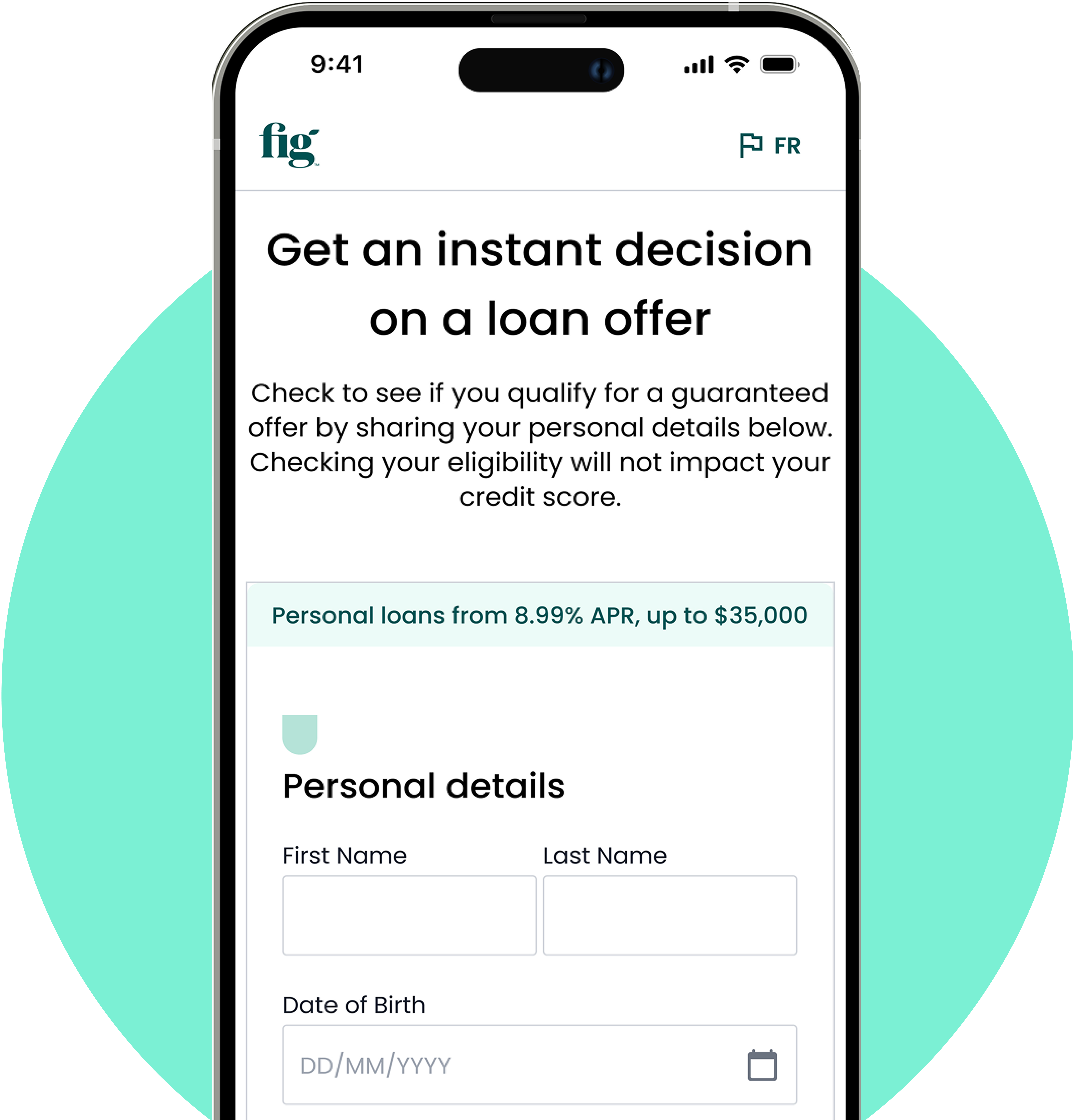

Check your rate in seconds

Find out how much you can borrow and your rate offer—without impacting your credit score.

Complete your application in minutes

Only a few verification steps remain. No branch visit, no lengthy paperwork.

Get your loan in days

Pay off your loan on your terms with flexible payments and no early repayment fees.

Learn more about home improvement loans

See how a personal loan can help you get your home improvement project started sooner

Home improvement loans FAQ

A home improvement loan is a type of loan used to help homeowners finance renovations or upgrades to their property. These loans can be secured (like a home equity line of credit) or unsecured (like a Fig personal loan).

- Secured line of credit based on your home equity

- Variable interest rates

- Borrow only what you need, repay it, and borrow again as needed

- Risk of foreclosure if you default

- Unsecured loan

- Fixed interest rates

- Lump sum deposit with fixed repayments

While a HELOC is more flexible and can be used for ongoing expenses, a personal loan might be better for one-time, predictable borrowing needs without the risk of losing your home.

If your project comes in under budget, enjoy the flexibility of paying back your loan early with no penalties or fees.