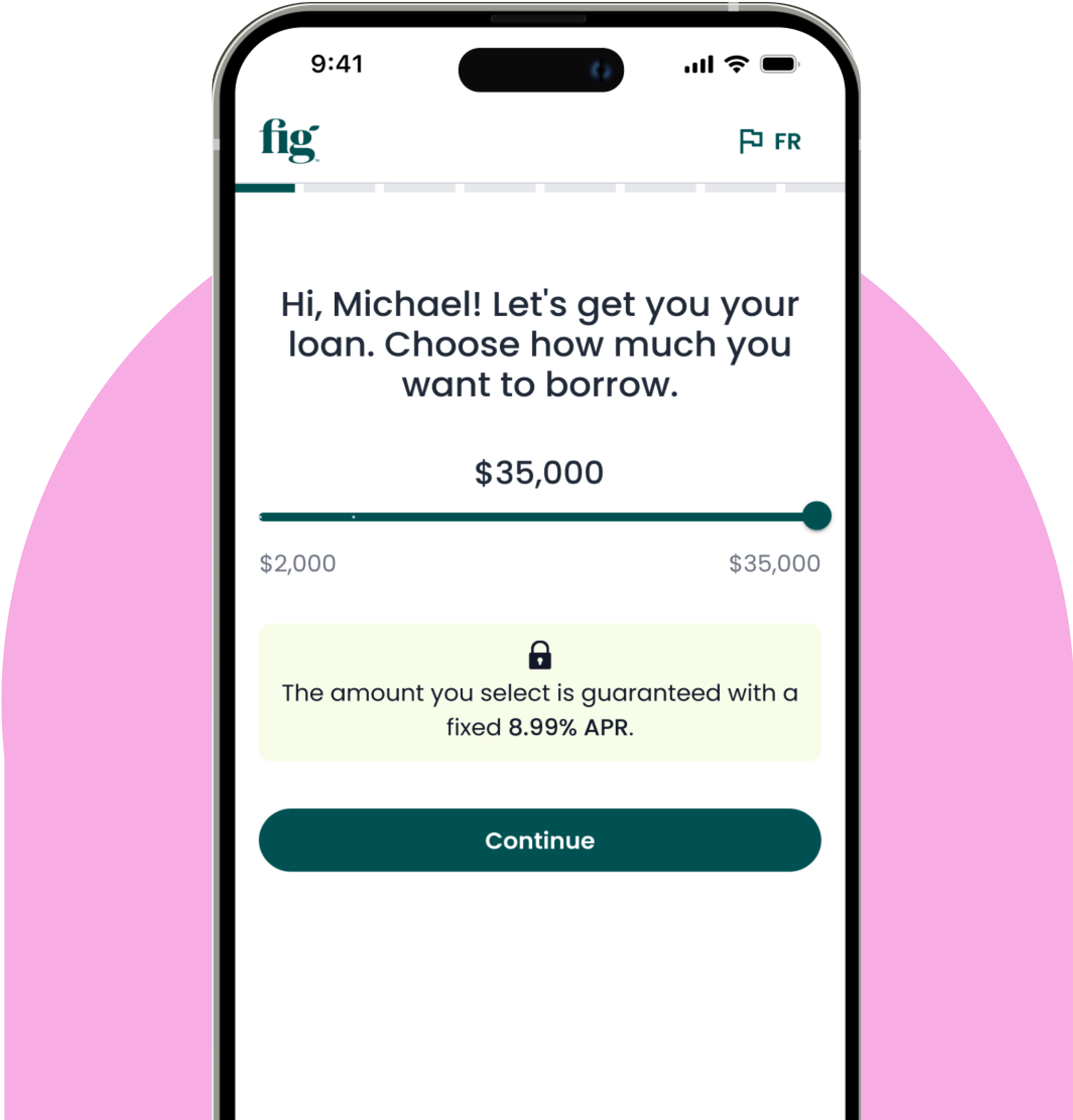

Borrow up to $35,000

Rates as low as 8.99%*

Funding as early as 1 business day

No hidden fees

See how a Fig unsecured personal loan can benefit you

Why choose Fig for an unsecured personal loan

Learn how an unsecured personal loan could help you achieve financial freedom faster

Manage the

unexpected

Fig personal loans help you get the funds you need fast, with cash available in as little as one business day.

Fig personal loans help you get the funds you need fast, with cash available in as little as one business day.

Fast approvals

Check how much you could be approved for in less than 60 seconds - plus receive your funds in as little as one business day.

Check how much you could be approved for in less than 60 seconds - plus receive your funds in as little as one business day.

No collateral required

With unsecured personal loans, you don't need to put up assets (like your home or car) to secure the loan.

With unsecured personal loans, you don't need to put up assets (like your home or car) to secure the loan.

Improve your cash flow

Better financial flexibility could mean more money in your pocket for the things that really matter in life.

Better financial flexibility could mean more money in your pocket for the things that really matter in life.

Better financial management

Take advantage of fixed interest rates and predictable monthly payments, making it easier to budget and manage your finances.

Take advantage of fixed interest rates and predictable monthly payments, making it easier to budget and manage your finances.

Trusted by thousands of happy Canadians

‘Fig Financial has helped me breathe…

Fig Financial has helped me breathe again! A small personal loan to cover debts in easy monthly payments is all that I needed. It helped my credit score and gave me peace of mind.’

- D W

How to get an unsecured personal loan online

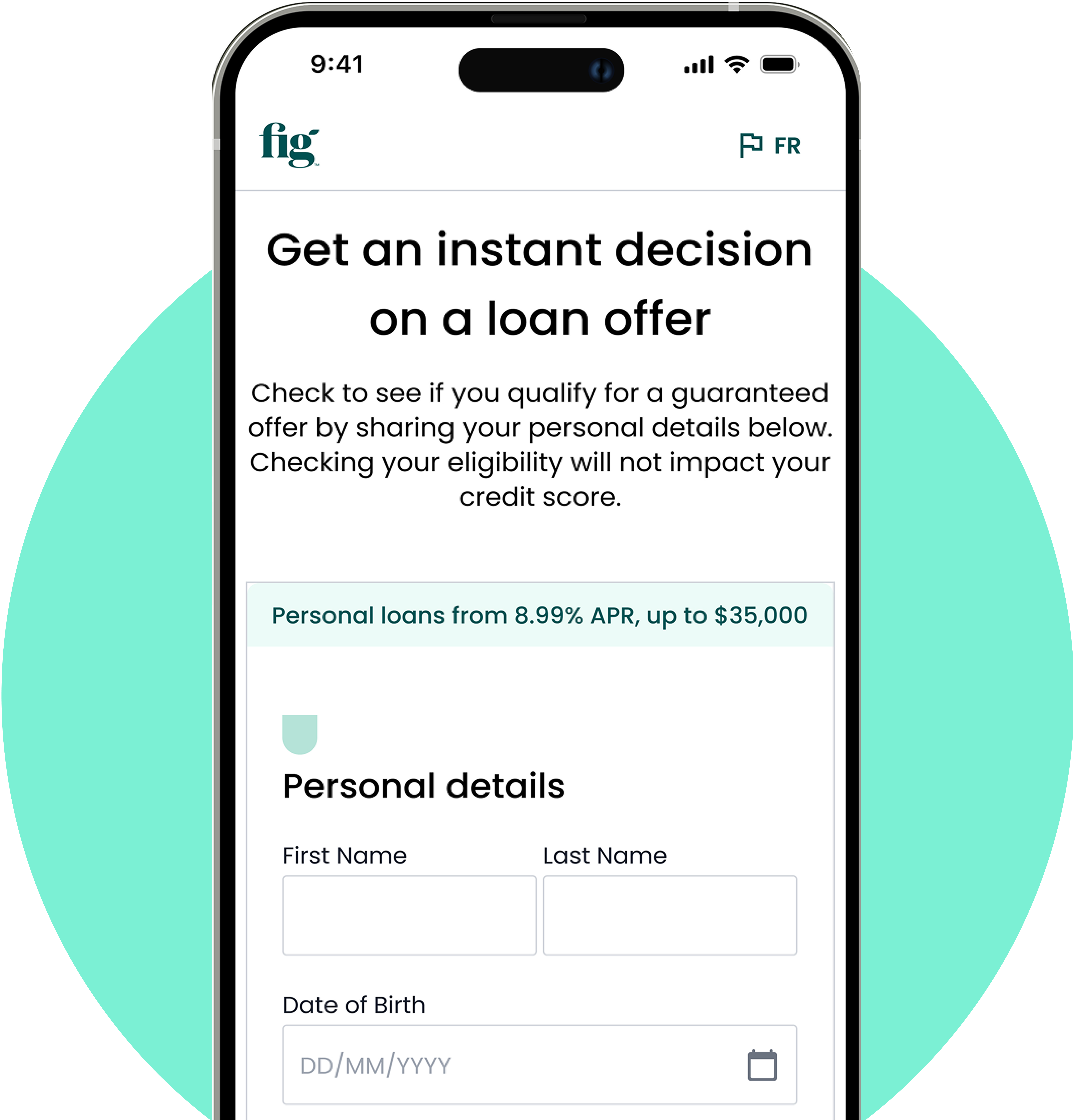

Check your rate in seconds

Find out how much you can borrow and your rate offer—without impacting your credit score.

Complete your application in minutes

Only a few verification steps remain. No branch visit, no lengthy paperwork.

Get your loan in days

Pay off your loan on your terms with flexible payments and no early repayment fees.

Learn more about unsecured personal loans

See how unsecured personal loans differ from other credit products

Unsecured personal loans FAQ

An unsecured personal loan is a type of loan that doesn’t require collateral (such as your home or car) to secure it. These loans are often used for purposes like debt consolidation, home improvements, medical expenses, or major purchases.

The amount you can borrow depends on your creditworthiness and other credit factors. Fig loans range from $2,000 to $35,000 with terms from 2 to 7 years.

Yes! You can pay your Fig loan back early without any penalties.